Although BCBS IL still has the market share of business in Illinois, don’t forget to consider Humana as well. This blog will discuss where Humana might fit your group’s specific needs.

Recently, Humana came to MIBS to present Humana for 2018. Key points that were covered include:

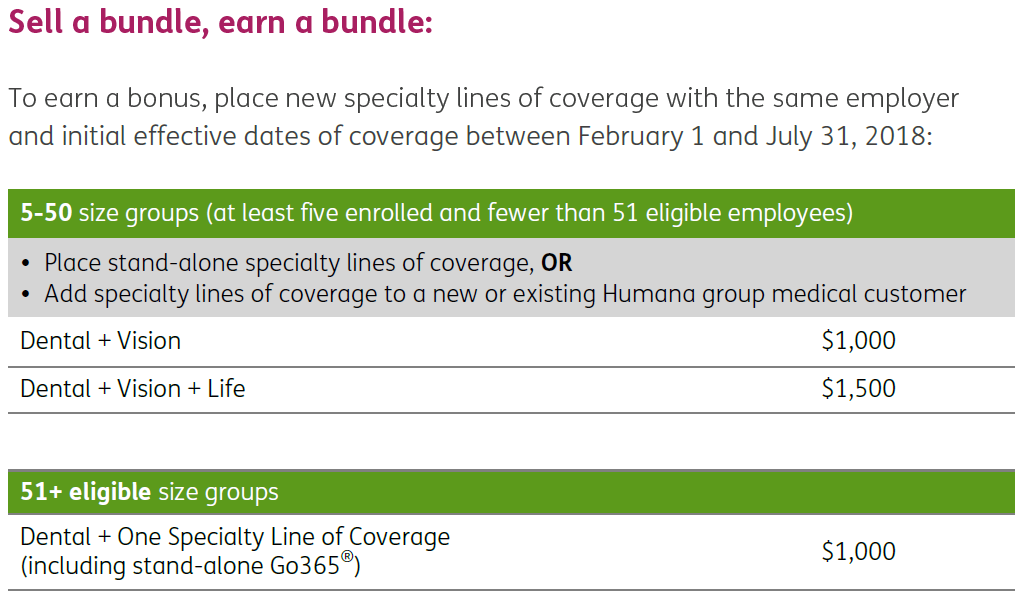

- Humana Dental and Vision still strong in today’s market (Check out the Humana Bundling Bonus at the end of the Dental Vision section)

- Humana’s Level Funded Product is strong and competitive (Check out the Humana Level Funded Premium Bonus at the end the Level Funded section)

- Humana’s CCN HMO network provides a workable solution to contain premium costs

space

space

Humana Dental

Next to medical costs, dental expenses can create a serious strain on an employee’s budget. Groups offering dental not only assist the employee financially, but also increase the health of that employee as regular dental exams screen for many medical conditions increasing chances of early detection.

Eligibility for Humana Dental

- Groups with 2-100 enrolled are eligible for dental coverage.

- Humana does not enforce contribution requirements for dental plans

- Participation requirements for employer sponsored is 50% participation after valid waivers are removed and a minimum of two enrolled. Groups unable to meet the 50% participation will be enrolled in a voluntary plan and must have at least two enrolled.

- Employers with 10 or more employees enrolled can offer more than one dental plan: 10-24 enrolled can offer 2 dental plans and 25-100 enrolled can offer 3 dental plans.

Humana Dental Plans

Humana Traditional Preferred

This is a flexible plan with low deductibles and ability to see any dentist. However, when members see a dentist in the Humana Dental PPO network, they benefit from the negotiated rates from in-network providers.

- Calendar-year maximums range from $1,000 to Unlimited.

- Humana offers an extended annual maximum of 30% coinsurance for the rest of the year after the annual maximum for the year has been reached (orthodontia excluded).

- Employers can select an open enrollment period to limit when employees can enroll in the dental plan or allow late applicants where an employee can enroll at any time during the year without a qualifying event.

Buy up options (for an additional cost):

For groups 2+

- Waive preventative services from accumulating to the annual maximum

- Move Periodontic services to Basic services coinsurance amount

- Move Endodontic services to Basic service coinsurance amount

- Cover composite fillings on molar teeth at Basic services coinsurance amount.

- Orthodontia child or adult/child {50% coinsurance (no deductible) to a lifetime maximum of: $1,000/$1,500/$2,000}

For groups 10+

- Implant placement and services

Humana PPO

In-network dentists provide dental services at a reduced rate. Members have higher out-of-pocket costs for services received from out-of-network dentists.

- Calendar-year maximums range from $1,000 to Unlimited.

- Humana offers an extended annual maximum of 30% coinsurance for the rest of the year after the annual maximum for the year has been reached (orthodontia excluded).

- Employers can select an open enrollment period to limit when employees can enroll in the dental plan or allow late applicants where an employee can enroll at any time during the year without a qualifying event.

Buy up options (for an additional cost):

For groups 2+

- Waive preventative services from accumulating to the annual maximum

- Move Periodontic services to Basic services coinsurance amount

- Move Endodontic services to Basic service coinsurance amount

- Cover composite fillings on molar teeth at Basic services coinsurance amount.

- Orthodontia child or adult/child {50% coinsurance (no deductible) to a lifetime maximum of: $1,000/$1,500/$2,000}

For groups 10+

- Implant placement and services

Humana’s Preventative Plus

This is a great option for those groups offering Dental for the first time. This is a low cost plan that covers preventative services at 100% and some basic services at 80% (in-network). Plus, discounts may be available on additional services, like crowns, inlays, oral surgery and orthodontia. Since most dental plans have a waiting period of 12 months before coverage for major services (waived if group offered dental for the prior year), new groups without prior dental coverage might want to purchase the Preventative Plus plan for one year and then upgrade to a more comprehensive coverage. Humana’s Preventative Plus offers two plan options shown below:

Calendar year maximum of $1,000

Coinsurance Option 1 Option 2

Preventative 100% 100%

Basic services 80% 50%

(Emergency care, fillings & simple extractions)

This dental plan already has a very low premium. Adding the buy ups is very inexpensive and would allow more money for dental treatment and move fillings to a basic service coinsurance amount.

Waiting Periods for Traditional Preferred, PPO and Preventative Plus plans:

Most services in your plan are reimbursed as of the effective date

No waiting periods for preventative services

No waiting period for endodontics or periodontics except for late applicants

Waiting Period Chart

| Enrollment Periods | Group Size | Preventative Services | Basic Services | Major Services | Orthodonita |

|---|---|---|---|---|---|

| Initial enrollment, open enrollment and timely add on | 2-9 enrolled | No | No | 12 months | 24 months |

| Initial enrollment, open enrollment and timely add on | 10+ enrolled | No | No | No | 12 months (no waiting period for employer sponsored) |

| Late Applicant | 2-9 enrolled | No | 12 months | 12 months | 24 months |

DHMO Dental Plan

Members may see a primary care dentist as often as necessary. There are no yearly maximums, no deductibles to meet and no waiting periods. There are 3 plan options for this plan with specified copays per service. The list of copays can be found in the plans summary of benefits. Members needing to see a specialist can be referred or self-refer to any participating specialists (endodontist, oral surgeon, periodontist, pediatric dentist). This plan has a similar cost as the Preventative Plus plan with buy ups.

Humana Vision

- Groups with 2-100 enrolled are eligible for vision coverage.

- Groups must bundle vision with either medical or dental if Voluntary or less than 5 employees are enrolling.

- Employer sponsored Vision can be purchased standalone if 5 or more employees enroll.

- Humana does not enforce contribution requirements for vision plans.

Participation Requirements:

Employer sponsored

2+ group size enrolled with medical or dental

- Minimum of 50% participation with at least 2 enrolled

- Participation is either 50% or two enrolled employees, whichever is greater

- Groups not able to meet participation requirements must enroll in a voluntary plan (voluntary participation requirements are listed below)

5+ Group size enrolled written stand alone:

- Minimum of 50% participation

- Minimum of 5 enrolled employees is required

- Participation is either 50% or 5 enrolled employees, whichever is greater

- Groups not able to meet participation requirements must enroll in a voluntary plan (voluntary participation requirements are listed below)

Voluntary:

2+ group size enrolled with medical or dental

Minimum of 2 enrolled employees is required

5+ Group size enrolled written with medical or dental

Minimum of five enrolled employees is required

Vision plan details can be found in the Humana Product Grid located at the end of this blog.

Humana Life

Groups with 2-100 enrolled are eligible for life coverage.

The employer is required to contribute toward the cost of the group insurance program to ensure the employer has a vested interest in providing insurance coverage for their employees.

Contribution Requirements:

- Non-contributory: employer pays all the cost of the employees’ premium.

- Contributory: employees must pay a portion of their premium.

- Contribution requirements: 50%

Participation Requirements (Basic Life):

Employer sponsored

Non-contributory – requires 100% participation of eligible employees

Contributory

2+ group size written with medical or dental

- Minimum of 50% participation

- A minimum of 2 enrolled employees

- Participation is either 50% or 2 enrolled employees, whichever is greater

- Groups not able to meet participation must enroll in a voluntary plan

5+ group size written stand alone

- Minimum of 50% participation

- A minimum of 5 enrolled employees

- Participation is either 50% or 5 enrolled employees, whichever is greater

- Groups not able to meet participation must enroll in a voluntary plan

Voluntary Life

A minimum of five or 25%, whichever is greater, enrolled employees is required

Employer sponsored term life

Minimum benefit in $15,000 and maximum guaranteed issue amounts go up based on number of employees enrolled. This life product is portable.

Humana Level Funded Group Health Plans

Level funded group health plans are steadily gaining popularity as businesses continue to look for ways to lower the costs of their group health benefits. Humana does offer Level Funded plans and when you combine this with their Wellness Program, Go365, you can offer a group a plan that offers a potential of premium credit if plan year has less claims than their claim fund and a means to control claims by increasing wellness within the group.

- Level funded group plans have fixed monthly premiums based on employee enrollment.

- No downside risk at year end – just an upside potential of getting money back.

- Group does need to renew with Humana to qualify for premium refund.

- Requires a minimum of 10 enrolled employees and can go up to 300.

- Humana’s sweet spot is 10-25 employees.

- Go365 Wellness Engagement incentives are included

- Humana will use standard COBRA administration but no IL continuation.

- Settlement will occur 3 months after plan year ends.

- Humana will continue to pay claims run out for 12 months after the plan year ends.

- Claims surplus reimbursement will be in the form of an administrative fee credit.

- Level funded plans are medically underwritten and are not guaranteed to issue.

- Quotes start with a base quote and then employee application and employer paperwork is sent for firmer rates.

- Telemedicine copay now $0 (HDHP plans will pay max of $49).

- Can offer up to 3 plans

- Plan changes can only be made at renewal

Plans and networks:

Plan types include:

- Simplicity

- Traditional

- HDHP

Networks Include:

- Humana Choice Care Network

- NPOS PPO

- HMO Select

Rules of the Road

Participation requirement is 50% of eligible employees.

Completed sold paperwork must be submitted 15 days prior to effective date.

Level funded groups receive final SBCs during the installation process.

Please note, any changes in census submitted to new case processing (new Humana group) or to plan change (existing Humana group) can impact rates.

The employer and agent will receive quarterly finance reports that include 3 months of premium versus claims data.

Industries not eligible for Level Funded Premium:

- Hospitals

- Schools that are local or state funded

- State or local government entities

- Religious organizations

Humana Level Funded Premium Bonus – 2/1/18 – 7/1/18

- $25 per Level Funded Premium subscriber

- $5,000 for 3-4 cases sold

- $10,000 for 5-9 cases sold

- $25,000 for 10+ cases sold

Bonus is for new business with an effective date between 2/1/18 – 7/1/18.

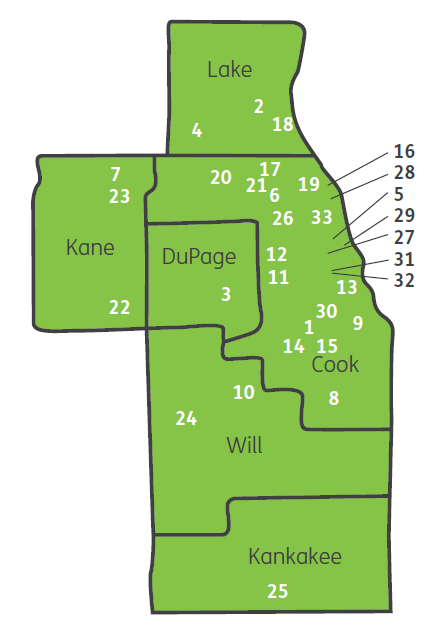

Humana’s Coordinated Care Network

Finally, let’s talk about Humana’s skinny HMO network that can save your clients money, up to 20%. Groups offering this HMO will offer all the CCN systems to their employees:

- Advocate CCN

- Loyola CCN

- Northshore CCN

- Northwest Community CCN

- Presence CCN

- Sinai Health CCN

- Swedish Covenant CCN

The map below shows where the hospitals are located for each system.

Advocate Health Care

1. Advocate Christ Hospital & Medical Center

2. Advocate Condell Medical Center

3. Advocate Good Samaritan Hospital

4. Advocate Good Shepherd Hospital

5. Advocate Illinois Masonic Medical Center

6. Advocate Lutheran General Hospital

7. Advocate Sherman

8. Advocate South Suburban Hospital

9. Advocate Trinity Hospital

10. Silver Cross Hospital

Loyola Physician Partners

11. Loyola University Medical Center

12. Gottlieb Memorial Hospital

13. Mercy Hospital and Medical Center

14. Palos Health

15. Little Company of Mary Hospital and

Healthcare Centers

NorthShore University Health System

16. Evanston Hospital

17. Glenbrook Hospital

18. Highland Park Hospital

19. Skokie Hospital

Northwest Community Healthcare (NCH)

20. Northwest Community Hospital

Presence Health System

21. Presence Holy Family Medical Center

22. Presence Mercy Medical Center

23. Presence St Joseph Hospital – Elgin

24. Presence St Joseph Medical Center – Joliet

25. Presence St Marys Hospital

26. Presence Resurrection Medical Center

27. Presence Saints Mary and Elizabeth

Medical Center

28. Presence St Francis Hospital

29. Presence St Joseph Hospital – Chicago

Sinai Health System

30. Holy Cross Hospital

31. Mount Sinai Hospital Medical Center

32. Schwab Rehabilitation Hospital and

Care Network

Swedish Covenant

33. Swedish Covenant Hospital

Rules of the Road

- Employees will pick which system they will use of the seven. Members must choose a primary care physician within the provider system they selected and have the freedom to visit specialists without referral from their primary care physician within that system as needed. Members would need a referral to go to a provider in a CCN system outside of their selected system. There are no out-of-network, non-emergency benefits.

- Employee and dependents must utilize the same system.

- Employees can only change system at open enrollment.

- Group submission deadline is the 15th of the month prior to effective date.

- EAP/Telemedicine/Go365/Wellness Engagement Incentives are included.

Ideas for selling Humana

Groups looking for a low cost HMO – let us quote the CCN network for you.

If you have current groups not offering vision, dental, or life, quote Humana. The effective date of the ancillary plan does not need to match the medical renewal date.

If you have groups that cannot afford medical coverage, consider offering some Humana ancillary products instead to help defray those costs and retain those valuable employees.

Do you have a healthy group who wants to have the opportunity to receive premium credits when they have a good claims year? Quote Humana level funded with Go365.

Take advantage of Humana’s unique products and receive bonus commissions.

Leave A Comment

You must be logged in to post a comment.