With winter slowly moving to spring, people start looking forward to warm weather and boating. MIBS agents can assist their clients in finding the right coverage for that new boat with Safeco Insurance and Travelers.

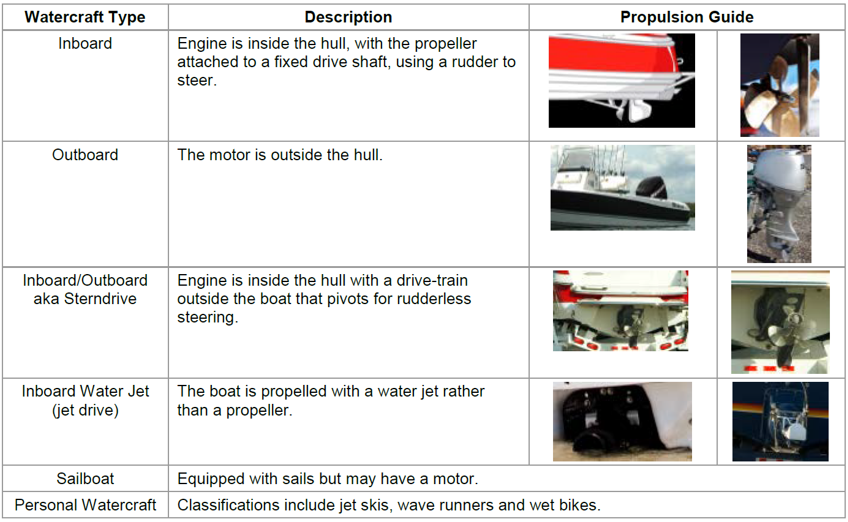

Watercraft Rating Categories

spacer

Safeco’s Watercraft Program

Safeco’s Watercraft Program is open to most types of watercraft used for recreational purposes. They offer a selection of coverages designed to provide protection to the insured operator and the watercraft.

Program Advantages / Selling Tips: Competitive Advantages

- Coverage for pets, personal property, and equipment such as water skis and marine electronics

- Standalone watercraft are accepted

- Agreed-value policy

- Eligible watercraft up to $300,000 and 40 feet

- Total price protection available for boats 2 years old and newer

- Roadside Assistance is available

- Emergency Assistance (on-water towing)

- Liability coverage only is available

- Towing and labor expenses

- Fuel spill and wreckage removal

- Optional fishing equipment coverage up to $20,000

- Additional Interest/Marina Additional Insured is available

spacer

Safeco also offers the Captain’s Package Option for boats of all ages

The Captain’s Package provides a valuable optional coverage. It can be added to new or existing policies for all boat ages. This option includes:

- Increased personal effects coverage

- New boat price protection

- Roadside Assistance

- Increased emergency assistance coverage (available in most states; see your state-specific Product Guide for details)

spacer

Travelers Boat, Yacht and Personal Watercraft Coverage

Travelers Boat Coverage

- Coverages and features (vessels less than 26 feet requires underwriter approval)

- Broad navigation territories covering the continental U.S. and Canada are available

- 12-month policy with no lay-up period

- Hull deductibles of 1 percent up to 10 percent ($100 minimum deductible)

- Wreck removal and accidental fuel spill coverage

- “Agreed Value” coverage in the event of a total loss (no depreciation and no deductible)

- If you select the option of reducing coverage to an Actual Cash Value (ACV) basis, you will receive a premium discount

- “Replacement Cost” coverage on most partial losses involving your vessel, its fixtures and electronic equipment

- Medical payments: $2,000 included (increased limits available)

- Personal property: $1,000 included with a $250 deductible (increased limits available)

- Towing: $500 included (increased limits available)

- Trailers: $1.50 per $100 with a $100 deductible

- Uninsured boater coverage: up to the limit of boat liability coverage

spacer

spacer

Travelers Personal Watercraft Coverage

Travelers personal watercraft insurance offers physical damage protection for the hull, comprehensive coverage for other kinds of damage or loss, plus liability coverage. Minimum hull value is $3,000.

Actual Cash Value – In the event of a total loss or theft, we pay the actual cash value, which includes a deduction for depreciation. For a partial loss, we pay the repair cost, minus depreciation for damaged parts.

Personal watercraft product eligibility (jet skis, etc.)

- Customer must have one or more companion policies such as boat, yacht, auto, home or condo.

- If your client has an umbrella policy with Travelers, remember to add the Personal Watercraft exposure to the umbrella using the PLUS 05 endorsement.

- The minimum premium is $175.

- Personal watercrafts (PWC) more than 15 years of age are ineligible.

- The PWC principal operator must be at least 21 years old and have three years of boating experience.

- The maximum liability coverage is $300,000 and the maximum medical payments coverage is $5,000.

- Our deductible starts at 3 percent of the insured value of the PWC.

- Inland and coastal risks are eligible.

If your client is purchasing a boat, don’t just quote the boat, suggest quoting the home and auto as well to get the most discounts unless you already are the agent for those policies.

If your client also has an umbrella policy, your customer service representative will make sure the boat or personal watercraft is added. If your client doesn’t have an umbrella, this might be a good time to talk about it.

All policies are subject to underwriter review, including acceptable driving record/operator experience. Some boats may require surveys depending on the age and value of vehicle.

To request a quote for a watercraft, use the link below:

spacer

Please contact your customer service representative at MIBS with any questions.

Nancy Trafford: nancy@midwestga.com 847-631-6653

Lionel Romero: lionel@midwestga.com 847-631-6657

Leave A Comment

You must be logged in to post a comment.