Dearborn National Group Benefits

Recently, Dearborn National held a seminar here at MIBS and discussed not only their products but also how employers and members can best use them. Although Dental and Vision are easy to use, Term Life and Disability may be unfamiliar to your employer and employee. How life insurance and disability insurance works with employees who may not be actively working was new information for me and I felt this was important for agents to know. I have included this topic toward the end of this blog.

Dearborn National is the ancillary carrier partnered with BCBS IL but their products can also be sold stand-alone without medical benefits. Their products include:

- Life Insurance

- Short Term Disability

- Long Term Disability

- Vision

- Critical Illness

- Accident

Contracted agents have access to the Producers Corner on the Dearborn National website where you can see your business and much more.

Benefits that might be unique with Dearborn Life include:

Dearborn Cares: provides an advance payment of the life insurance benefit to help beneficiaries cover their immediate expenses without a death certificate. The remaining balance will be paid after the death certificate has been submitted and underwriting has processed the claim.

Solutions for Education Professionals: offers enhanced benefits for K-12 school employees and college and university employees and includes, additional benefits for campus violence, college assistance, disability coverage during school breaks, and office depot discounts.

Vision Plan Powered by EyeMed with one of the largest networks available.

Group Eligibility Considerations

- Eligible businesses must have been in business for 2 years

- All active, full time employees working at least 30 hours per week are eligible for coverage

- Certain industries may not be eligible for one or more lines of coverage

- Carve out groups are acceptable with approval

Participation Requirements for groups with 9 employees or less

Non-contributory or employer sponsored plans require 100% of all eligible employees be enrolled.

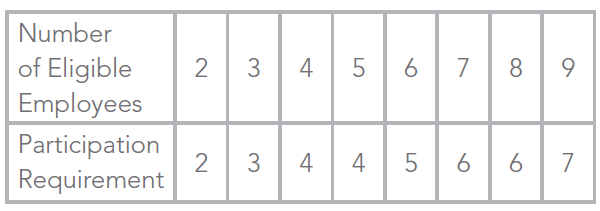

Contributory or voluntary sponsored plan’s participation requirements for groups 9 and under are:

Participation is reviewed on the group’s anniversary.

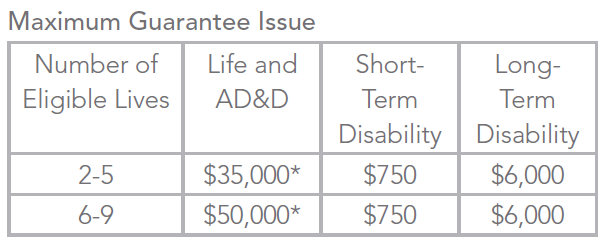

Amounts above the guaranteed issue will require evidence of insurability.

Requirements for groups with 10-99 eligible lives, please click on the link below:

Space

Space

space

Space

Additional Insight on How Group Life and Disability Plans Work

An agent’s job does not end with the sale but should continue by making sure the insured knows how to use the product. With medical benefits, this is naturally done because these benefits are used on a regular basis. However, life and disability are only used upon death or a medical condition that is disabling so how to use these products may be less familiar to employers and employees.

Group life and disability plans offer benefits to active eligible employees only. Some products are portable, meaning that when the employee is no longer active, they can convert the policy to an individual product that they can keep. It is important to understand how this product works when an employee experiences a condition that is disabling so that coverage is not terminated inappropriately or benefits are declined. Let’s first understand the basic terminology of this product.

Definition of total disability: When an employee is unable to perform the material and substantial duties of his or her occupation on a full time or part time basis, and is not receiving any earnings for work or service. Disability must be certified by a physician. After benefits have been paid for 24 months, disability is then determined by the insured’s ability to perform all of the material and substantial duties of his or her own or any other occupation for which they are qualified for by training, education, experience, age and physical and mental capacity.

Definition of partial disability: When an employee has a disability but is able to perform one or more (but not all) of the material and substantial duties of his own occupation or any occupation on a full time or part time basis. Dearborn will pay partial disability benefits once the insured has met the elimination period with a combination of total and/or partial disability and is earning less than 80% of the pre-disability income. This benefit pays up to 100% of the maximum benefit during the first year of the partial disability. After one year, the benefit reduces to the benefit percentage less any income from other sources.

Upon initial determination that an insured is disabled, a physician will determine if the disability is total or partial and it will initially be considered temporary. Permanent disability cannot be determined until the member has been under a physician’s care and treatment for 9 months. After 9 months, the physician can then determine if the disability is resolved, temporary or permanent.

Waiver of premium

About 9 months into a disability, the member should file for a waiver of premium claim. Dearborn reviews the claim and determines if the member is eligible. Please note: to be eligible for Waiver of Premium review the member must be truly disabled and the premiums MUST be paid on the coverage for 12 months from the date of disability. If there is still no determination of the WOP (wavier of premium) claim review by that time, they must drop the member off the coverage and offer conversion and/or portability, if they are eligible.

Short Term Disability

Short term disability provides income protection when an insured is physician certified to be disabled. The duration for the short term disability can be 13 or 26 weeks. If offering long term disability as well, you would match the short term duration with the waiting period for the long term policy.

Maternity is an illness that is considered to create a disability so women who have given birth qualify for disability benefits. For a natural birth, women can receive 6 weeks of disability after their elected waiting period. Cesarean births qualify for 8 weeks after their elected waiting period. Short term disability is a great product for female employees of child bearing age.

How would an insured access their benefits? Prior to delivering the baby, the mother should start completion of the Group Short-Term Disability Claim form. This form requires completion by the employee, the employer and attending physician or physicians. When all information from all parties is received by Dearborn, they will begin evaluation of the claim.

This same process would be used for any medical condition that the insured’s physician deems disabling.

Long Term Disability

Dearborn’s short term and long term disability, when paired together, provide seamless income protection when an insured’s disability goes longer than the short term disability duration period. Groups can select from a few duration periods for their long term disability:

- To SSNRA (Social Security Normal Retirement Age)

- 5 years

- To age 70

Dearborn offers two elimination or waiting periods:

- 90 days

- 180 days

How does the member access the benefits?

If the member had a short term disability plan with Dearborn and the physician continues to certify the disability, then Dearborn will continue to pay the benefits when the short term duration period ends. Based on the type of claim, Dearborn will set reminders requesting additional information from the claimant and physician.

If the member only has long term disability, they would need to complete the claim form including the employer and physician portion and submit to Dearborn.

Situations to consider:

Temporarily disabled employees may lose their group eligibility when they go on disability because they can no longer work. It is very important to notify Dearborn by submitting a claim form with a physician’s certification of disability so that they will not be ineligible for coverage. The employer should continue to pay that employee’s premium for up to 12 months from the date of disability. If the employer does not continue to pay the premium, then the employee should be offered the opportunity to convert the policy if that is available.

In the event the employee does not have short term disability but has long term disability, submit the claim form 30 days prior to the end of the elimination period. The employer needs to understand that the member no longer able to work, will not be eligible for benefits unless they are deemed disabled and the premiums continue to be paid.

Group Life Insurance

Group life insurance is an inexpensive product that offers very valuable income protection in the event of death.

Life plans include:

- An Accelerated Death Benefit to help terminally ill employees. Terminally ill employees may receive 50% of their group term life insurance amount with a maximum of up to $50,000 and a minimum of $7,500.

- A waiver of premium if the employee is unable to work because of disability due to injury or illness for a minimum of 9 months and is under 60 years of age. Premium payments will be waived until the employee is no longer disabled or reaches age 65.

This product will only pay benefits for active employees unless they are disabled. If an employee is unable to work due to an illness or accident and are deemed disabled, then they will still be eligible for benefits. If the illness of injury could result in the potential of imminent death, it is very important to assist the employee to either submit the documents to validate disability or offer the employee the opportunity to convert the policy. The accelerated death benefit may be very useful for the employee and their family so maintaining the eligibility of the employee to keep this coverage could be important.

For your groups offering life or disability, it is important to advise the group on how to handle these kinds of situations and in the event an employee suffers a serious accident or illness, to contact the agent or carrier to see what needs to be done for the employee to continue to be eligible for benefits during this time.

Last Thoughts about Selling Ancillary Products

- With a new group, don’t forget to ask if they want ancillary.

- If the group cannot afford to offer the medical, ask if they would like to at least offer ancillary products.

- If you recently placed a new group, follow up to make sure they registered on Blue Access for Employers and ask about ancillary products.

- When discussing your group’s renewals, discuss ancillary products to add.

- It isn’t a bad idea to have a group’s medical and ancillary renewal dates be at different times of the year.

Contact your customer service representative at MIBS with any questions.

Leave A Comment

You must be logged in to post a comment.