Here is What is New for Group Health in 2018

With a large percentage of health groups renewing 1/1/2018, I thought it would be good to talk about Group Health Insurance for 2018. With a little preparation, agents can assist their current group health accounts as well as place new group business during this upcoming busy season.

Group Health Goals

- Assist current group health plans to make plan changes to stay with BCBS IL for a 1/1/2018 effective date.

- Place new BCBS IL group health business

- Find those businesses who wish to place group health during the Group Open Enrollment Period

2018 Group Changes

BCBS discontinued all 2017 group plans and now offers different 2018 plans. Groups renewing in 2018 will notice these plan changes in their renewal. You can click on the links below to see the 2018 product charts.

If your group has had plan changes for their 1/1/2018 renewal, remember that the group is required to provide the SBCs for any new plans to those employees enrolled.

Prescription drug changes effective 1/1/18

- 6 Tier Drug Card (Generic Preferred, Generic Non-Preferred, Brand Preferred, Brand Non-Preferred, Specialty Preferred, Specialty Non-Preferred)

- Rx claim charges will now accumulate in separate buckets between in network and out of network claims

- Preferred Pharmacies remain the same: Walgreens, Albertson/Osco, Walmart/Sam’s Pharmacy and Access Health

Vision will have no changes in 2018

Virtual Visits/MDLive

- ACA plans will have access

- Grandfathered and Grandmothered accounts will gain benefit at the 2018 renewal

- HMO accounts to not have access

- Charge will be office visit copay. If no copay, fee will be $44 until deductible has been met then Ded/Coinsurance

- Behavioral Health ($80-$180 depending on service)

ACA Age Curve Band change:

- 0-14 (one rate)

- 15-64+ has their own individual rate per age

- Dependent cap remains at 3 for dependents aged 0-20 – the oldest dependent’s rates will be used

January 1, 2018 Group Renewals

Deadline for plan change documents to arrive at MIBS is 11/30/2017.

MIBS paperwork due dates are earlier than Blue Cross Blue Shield’s due to the high volume of renewal paperwork received.

After reviewing all of our group renewals for the last 6 months, I started thinking…….

Below are some of my thoughts that might inspire some solutions for your group renewals:

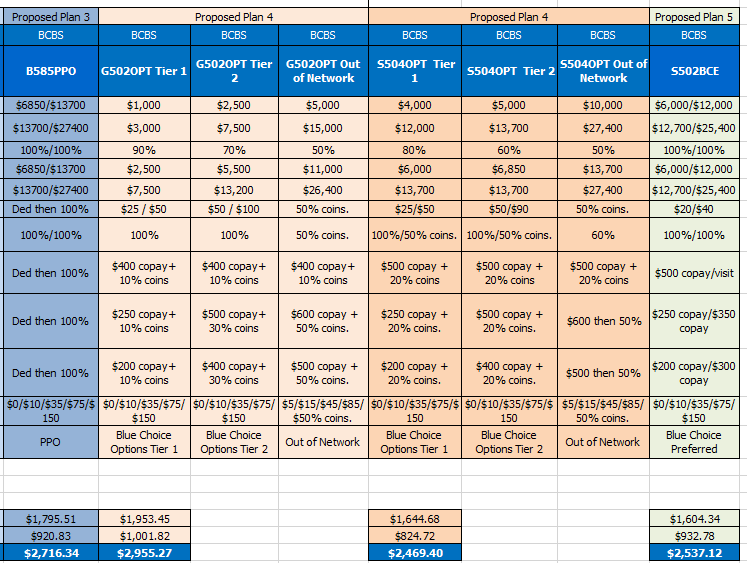

Blue Options/Blue Choice Options BCO

- I am seeing a lower premium for this plan for those groups currently enrolled in either the Silver PPO or Bronze PPO plans.

- For groups currently enrolled in Gold PPO plans who are looking for cost savings, this hybrid plan may be an option. They will definitely receive lower premiums but still have access to a large PPO network.

- This is a hybrid plan that offers one network but two tiers of benefits.

- Tier 1 is a rich benefit using a small PPO network.

- Tier 2 is less rich but uses a large PPO network.

- Tier 1 and Tier 2 deductibles and out-of-pockets cross accumulate. This means that if the member meets their $700 deductible in Tier 1, that $700 amount is also applied to the Tier 2 deductible. If the member meets their $1500 deductible in Tier 2, then their Tier 1 deductible has been met and the total amount was applied to the Tier 1 out-of-pocket.

- The secret to using this plan is understanding how to search the provider finder. When searching this Network on the Provider Finder, click on Blue Options/Blue Choice Options (BCO) and enter your search criteria. When the results page comes up, click on “Display all in network providers” under the “Narrow your Results by:” to show both Tier 1 and 2 providers.

Below is a link to a word document with instructions on searching the provider finder to give to your clients.

When presenting these plans to a group, it helps to show them using a spreadsheet format.

Below is an Excel document with templates for all of the 2018 Blue Options plans for your use. You can copy and paste onto your group’s spreadsheet to show the benefit design and then enter their premiums based on their renewal.

Groups offering the Platinum PPO plans

I saw a large number of groups with significant premium increases this last quarter. That makes a big impact for those groups offering the very expensive Platinum PPO plan. Is this really the smartest plan to purchase for a group that can afford this expensive plan?

Alternative Ideas:

- H.S.A. plans offer lower premiums and the opportunity to take some tax deductions. Employers can fund the employee’s H.S.A. account to defray the additional out-of-pocket that the higher deductible creates. Employees now get to keep the money if they are healthy and use it for other qualified expenses. This may also make the employees more conscious of their medical costs, thereby potentially controlling the total claim amounts being submitted resulting in less premium increase at renewal.

- Higher deductible PPO plans also offer lower premiums. The employer can set up an HRA account to cover any amount of that deductible which is higher than their current plan. If the employees do not use that money for claims, the employer gets to keep it. The employer can use TASC to administer the HRA account. Any fees associated with the administration will probably be nominal considering the money being saved in premium using this strategy.

- HRA arrangements can use either a regular PPO or H.S.A. plan.

Below is a chart of the Small Group plans that are H.S.A. qualified:

Blue PPO Network

- G533PPO

- G535PPO

- S534PPO

- B536PPO

- B535PPO

Blue Choice Preferred Network

- G533BCE

- G535BCE

- S534BCE

- B536BCE

- B535BCE

Blue Options/Blue Choice Options Network

- S507OPT

Transitional or Grandfathered Groups

Overall, it seemed that these groups were less affected with the substantial increases for premium. However, there were those groups that it did make sense to move them to ACA plans.

- Be sure to review each group to see if they need to move to ACA plans.

- If the grandfathered group chooses to keep their plans, be sure to get their grandfathered paperwork in as soon as possible.

- Deadline for Grandfathered paperwork to be at MIBS for a 1/1/2018 effective date is 11/30/2017.

- Groups with grand-mothered or transitional plans who wish to keep them, do not need to do anything except continue paying their premiums.

Placing new BCBS IL group Business Tips

Both BCBS IL and your health customer service representatives compiled this list of helpful tips for increasing your success in placing new group business:

- Determine that the group is eligible for group benefits.

- Group had an average of 1 non-owner employee on the wage and tax for the prior year.

- Or if a husband and wife group, they have a true partnership in place and file a K1 1065

- The business is registered on the IL Cyberdrive: http://www.cyberdriveillinois.com/departments/business_services/corp.html

- To enroll a new small (1-50) group for 2018, agents need to submit the following initial paperwork:

- BPA (Benefit Program Application)

- 2018 BPS (Benefit Plan Selection)

- Group Employer Form (EGI)

- Most current quarterly wage and tax document (UI/340) reconciled – to reconcile, note by each employee name listed: F for full time, P for part time and T for terminated. If group has a new hire not listed, write their name and hire date on document.

- New hires not on wage and tax, we need a copy of their W4 and paycheck stub.

- Copy of a voided check for initial month’s premium binder payment.

- Copy of an employee application either enrolling or waiving for all eligible employees.

- All forms can be found on our website: https://www.mibsga.com/group-4/bcbs/enrollment/

- Check that all the above forms have matching names for the company enrolling

- Check that all forms are signed and dated within 60 days of effective date.

- Check for affiliates and that they match on EGI, BPA and Affiliate forms.

- Verify what the group wants regarding composite rates or age rates and note on BPS.

- Manage the employers expectation about the process of enrolling a group and that additional information may be requested both by MIBS and BCBS underwriting.

- Groups with union employees must provide a copy of the Union Bargaining agreement and on the BPA on the page with Additional Provisions page 7, write in “covering non-union employees only”.

Most frequently requested missing information:

BPA

- Is the group waiving the Waiting Period on initial group enrollment?

- Employer contribution for all tiers

BPS

- Composite or Age rating

- Yes or no for Life Products, Dependent Life, Short Term Disability

Employee Applications

- Group name on top of page 2

- Hire date

- Full plan name under coverage applied for

- If SEP application, check off SEP and write at top, SEP event

- Employee signs application in the wrong spot

- For HMO enrollment, need medical group for PCP

- First line on page one not filled out

Submitting fully completed documents speeds up processing.

Group Special Enrollment for 1/1/2018 effective date

This is the period when groups who do not meet employer contribution or employee participation requirements can enroll in a group plan.

Group submission paperwork must be submitted to MIBS between 11/1/2017 and 12/13/2017 for a January 1, 2018 effective date. If submitting a group for this special enrollment, please note that it is an SEP Group.

- Group must still be a business eligible for group coverage

- Only available for the small group market (1-50)

- Employer does not need to pay any portion of the premium

- Employee participation requirement is waived

- Perfect for that group that is still on Individual policies

- Group premiums are usually lower and offer richer benefits than comparable individual plans

- Businesses on individual policies can have access to large PPO network

Ideas to prepare for this busy time:

- As soon as BCBS starts releasing the 1/1/18 renewals, check to make sure you have received all of yours. If you are missing any, please contact your customer service rep.

- Confirm which groups still offer grandfathered plans and check to see if they need to move. If not, get that grandfathered paperwork to your CSR as soon as possible.

- Review all of your renewals to see who needs to make changes and start working on those.

- Make sure you are using the correct BPS for plan changes. There will be a new 2018 BPS being released.

- Look back over last year’s season and find what worked and what didn’t. Come up with solutions for what didn’t work.

As always, MIBS will continue to send out updates and new information as it is released. Be sure you glance at all communications from both BCBS and MIBS to find any news that applies to your business. Remember…

It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change. – Charles Darwin

Leave A Comment

You must be logged in to post a comment.