Jennifer Powell from Unum gave a seminar here at MIBS, August 16, 2017 and provided so much great information. The agents attending agreed. For those of you who were unable to attend, below are the highlights from the seminar.

Please take a few minutes to look over this blog and do not disregard. This is a fantastic opportunity for you to offer Unum products to your groups and have Jennifer Powell assist you. Remember how many of your groups renew Dec. 1st and Jan. 1st, your busiest time of the year? During this time, it is very understandable that you would not want to discuss adding ancillaries to your groups, however, Jennifer Powell can assist you.

- Start now and create a list of renewals that have the potential to enroll 10 employees

- Plan to ask for Unum quotes from your MIBS Customer Service Rep

- When MIBS sends those Unum quotes out to you, Jennifer will be copied and can assist you with the presentation and enrollment.

What a win, win situation. Your groups get needed ancillary coverage, they think you are great and you receive commission.

Now on to the seminar highlights…

Unum – Doing something right for over 165 years

Unum Building from 1848

Unum today in Chattanooga TN

Unum is the modern company that has evolved from first Union Mutual, founded in 1848, and Provident Life and Accident. Starting in 1986, the company used the name Unum. When you search ancillary products on the internet, Unum is always one of the very top carriers and there are many reasons why:

- “A” rated company

- Claims process that meets or exceeds industry standards

- Multiple award winning company including awards for most trustworthy or reputable company

- Ranks 258 on the Fortune 500

- Ranked 1st in group and individual disability *

- Ranked 3rd in voluntary benefits **

- Ranked 5th in group life ***

*LIMRA “US Group Disability Ins. 2015 Annual Sales and in force”

** Eastbridge US Worksite Report, Carrier results for 2015 (2016)

*** Gen Re 2015 US Group Life Market Survey (2016)

Unum Group Products Include:

- Short Term Disability

- Long Term Disability

- Group Life

- Dental

- Vison

- Supplemental

Requirements for enrollment

Minimum number of lives enrolled is 10, however, Unum allows part time employee participation as long as they work a minimum of 17 ½ hours. 1099 employees may participate with special approval as long as they receive their compensation exclusively from the group and work the required minimum hours. 1099 employee participation is subject to approval.

Tip: For voluntary groups, look for groups with a total of around 20 eligible employees, as that will increase your chance of meeting participation and the minimum 10 employees enrolled.

Why sell ancillary products?

- 66% of Americans would find it somewhat or very difficult to meet current financial obligations if their paycheck were delayed by one week.

- 77% of workers think that missing work for three months because of injury or illness would create a financial hardship, while half think it would cause a “great hardship.”

- Someone in America dies due to an accidental injury every four minutes

- 40% of working Americans live paycheck to paycheck. Half of all households could not raise $2,000 in a month if they needed to.

- The average Social Security Disability insurance benefit is only $1,100 a month and is reserved for disabilities expected to last for at least a year.

Group Health insurance offers very important protection against the rising costs of health care. However, families are experiencing additional financial hardship trying to cover the costs of dental care, vision and self-insuring when unable to work. Because of rising deductibles, limited networks, and increasing maximum out of pockets for medical care, employees are paying increasingly more for their medical care leaving less funds to pay for the remaining needs like dental, vision or saving for those days when they cannot work.

Employers that offer ancillary products in conjunction with their medical plans, provide more incentive for employees to remain with their current employer. These employees will also be more likely to take better care of themselves (regular dental and vision exams) resulting in more production and less missed work days.

Short Term Disability

- Temporary income stream with benefit duration of 3 or 6 months

- 60% income replacement

- Choice of elimination periods: 0/7, 7/7, 14/14, or 30/30

- No pre-existing condition exclusion/limitation for employer paid plans (all other modes will have a 3 month look back for 12 months after effective date. If group had prior coverage, Unum will honor that carrier’s preexisting rule until the 12th month of coverage.)

- Smooth transition from STD to LTD with no additional claim form to move to LTD.

- Occupational sickness or injury is not normally covered, however, Unum will cover disabilities due to occupational sicknesses or injuries for partners or sole proprietors who cannot be covered by Workers’ Compensation plans.

Tip: Employees who truly want and benefit from disability coverage are those that receive salaries between $30,000-$70,000 annually. Those under 30K cannot afford anything and those earning over $70,000, disability would not cover their expenses.

Long Term Disability

- Long term income stream with benefit durations up to age 65

- Up to $15,000 monthly benefit; higher benefit maximums may be available

- “Own Occupation” coverage for the first two years of disability or for duration of the maximum period of payment

- Broad range of elimination periods with 90 days and 180 days being the most popular

- Waiver of premium while benefits are payable (Unum will automatically note this and stop charging the group)

- Employer paid groups are guaranteed to issue.

- Voluntary group are guaranteed to issue but employees who do not enroll during initial enrollment period but later decide to enroll during a subsequent renewal, will be subject to underwriting.

- Includes HRAnswersNow/Benefit AnswersNow, work-life balance EAP and worldwide emergency travel assistance.

- This product for all contribution modes is subject to preexisting (3 month look back for 12 months after the effective date)

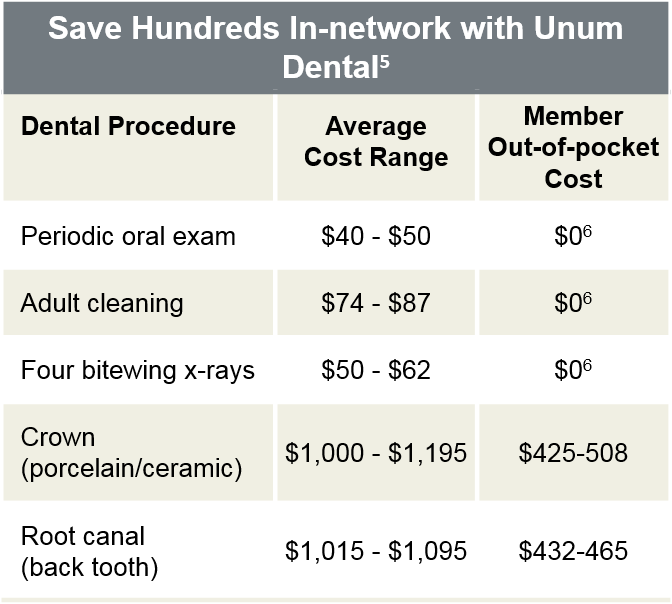

Dental

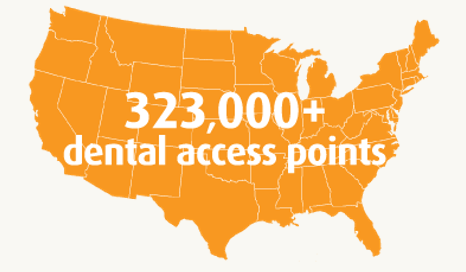

- Large national PPO network of more than 323,000 dental access points.

- Freedom of choice! Members are free to choose a new provider at any time, without prior authorization and with no penalty

- Customized ID cards

Annual Maximum Rollover Potential with Dental

Annual maximum rollover potential available (If employees receive one dental cleaning, one regular exam and total claims are below the threshold, member can rollover the set amount based on maximum benefits of plan to add to the next year’s maximum benefit).

Vision

Regular vision exams can help show signs of:

- Diabetes

- High blood pressure

- Macular degeneration

- Cancer

More than 40,000 vision access points, including independent and retail providers

What is needed to quote and sell?

To quote:

- Disability and Life

- Census with Gender, Date of Birth and Salary

- If have current coverage, plan highlights and inforce rates (this allows us to quote and provide better coverage and rates)

- Dental and Vision:

- Census with Gender, DOB, Zip Codes

- If have current coverage, plan highlights and inforce rates (this allows us to quote and provide better coverage and rates)

To Sell:

Get licensed and appointed with Unum (done when first policy is submitted)

Disability and Life Enrollment Forms

- Master Application signed by employer, Client Information Sheet

- Census with name, SSN, gender, DOB, date of hire and salary

Dental and Vision Enrollment Forms

- Master Application signed by employer, Client Information Sheet

- Census with Name, SSN, Home Address, Gender, Date of Birth, Date of Hire and Zip Codes

In summary, Unum is a simple but powerful equation:

Great product + Trusted carrier + Expert assistance = Happy clients and agents

Don’t lose potential opportunity for ancillary sales because of your end of year group renewals and Open Enrollment chaos. Start now with finding your potential groups, quote Unum and let Jennifer help you and your group. This is smart business.

Leave A Comment

You must be logged in to post a comment.